Light Line

8 800 220-0-220 Contact CenterBoard of Directors of JSC “MOESK” has approved Business Plan for 2014 and has taken note of forecast figures for 2015-2018 years, in particular has approved draft investment program for 2014-2018

We are open to cooperation and ready to offer information materials to journalists on the issues of the Company’s activity, help to arrange comments and interview with managers and leading specialists of PJSC “Rosseti Moscow Region”.

14.01.2014

The Board of Directors of Joint Stock Company “Moscow United Electric Grid Company” (JSC “MOESK”) on 27.12.2013 approved the Business Plan for 2014, including the investment program, and took note of the forecast figures for 2015-2018.

According to the Business Plan for 2014, the revenues of JSC “MOESK” will be RUR 128.0 bn (2.1% higher than the expected revenue for 2013), EBITDA – RUR 35.6 bn (-2.2%), net profit – RUR 7.8 bn (-28.7%), net debt – RUR 70.7 bn (+19.8%). The Company may pay annually 25% of net profit as dividends for the years 2014-2018 in accordance with the approved Business Plan and forecast indicators, continuing the practice of 2012 (in the case of positive decisions of the General Shareholders’ Meeting of JSC “MOESK” about the payment).

Business Plan for 2014 and forecast figures for 2015-2018

The annual revenue growth is planned for the years 2014-2018: if the figure is expected to be RUR 125.3 bn following the results of the year 2013, then the revenue is planned in the amount of RUR 128.0 bn for 2014 (+2.1% against 2013), and RUR 149.0 bn following the results of 2018 (+18.9% against 2013). The revenue target increase is mainly due to the planned growth of productive supply of electricity in 2014-2018 (81.6 bn kWh in 2014, +1.8% against 2013 and RUR 88.3 bn in 2018, +10.2% against 2013) and, consequently, the increase in electricity transmission revenue for this period (RUR 115.7 bn in 2014, +3.5% against 2013). According to the Company forecast for the years 2015-2018, grid connection revenue will decline annually: the figure is expected to be RUR 11.1 bn in 2014 (-13.0% against 2013), RUR 8.7 bn in 2018 (-31.9% against 2013). The decrease in grid connection revenue is associated with reduced tariffs for grid connection and exclusion of under-150 kW-applicants from grid connection (due to changes in legislative enactments).

The annual prime cost growth is expected as well during the five-year forecast period: the figure in 2014 will increase to RUR 111.2 bn (+6.3% against 2013), to RUR 134.2 bn in 2018 (+28.3% against 2013); at the same time, growth rates of the figure are ahead of the revenue dynamics. This trend is mainly due to the increase in the Company conditionally uncontrolled costs, namely the costs of services of JSC “UES FGC” and electricity costs for loss compensation. The Company continues to address losses reduction: losses reduction to 7.8 bn kWh is expected in 2014 (-3.2% against 2013), to 7.6 kWh in 2018 (-5.9% against 2013 year). The forecasted result of the work held to reduce losses is smoothed by the expected increase in the average electricity purchase price for their compensation: the price is expected to increase to RUR 1.88/KWh in 2014 (+11.9% against 2013), to RUR 2.56/kWh in 2018 (+52.4% against 2013).

Over the forecast period, no same dynamics is expected in respect of the figures of EBITDA and net profit: decline in EBITDA and net profit to RUR 35.6 bn and RUR 7.8 bn is expected in 2014 (-2.2% and -28.7% against 2013 respectively), followed by predominantly positive dynamics before 2018, when the figures projected will equal RUR 45.2 bn and RUR 9.6 bn (+24.4% and -12.9% against 2013 respectively).

In 2014, the negative impact on the Company financial performance, namely, the net profit will still be generated by the increase in the receivables impairment reserve. Following the results of 2013, the receivables impairment reserve amounted to RUR 10.4 bn, this reserve is supposed to include RUR 3.1 bn more in 2014. Formation of the reserve is due to receivables of JSC “Energocomplex” which has been generated for the period of the existence of “one contact” system.

The Company expects a growth of the average electricity transmission tariff to RUR 1,634.4/MWh in 2014 (+2.2% against 2013), while the average tariff can grow at a moderate pace up until 2017. In 2018, in connection with the beginning of a new tariff regulation period, the average tariff according to forecasts can grow up to RUR 1,830.7/MWh (+14.4% against 2013).

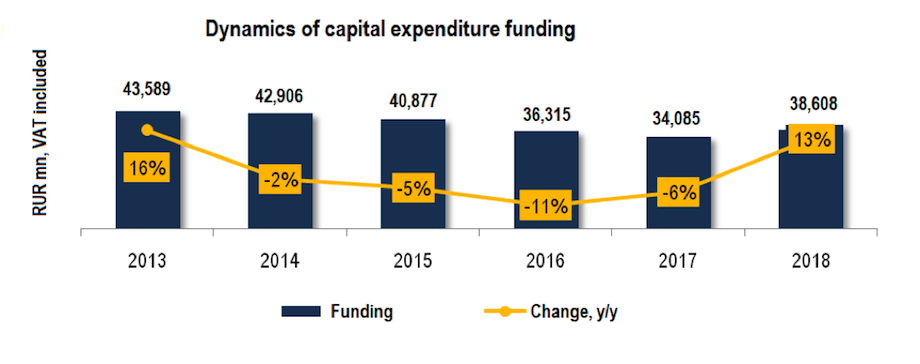

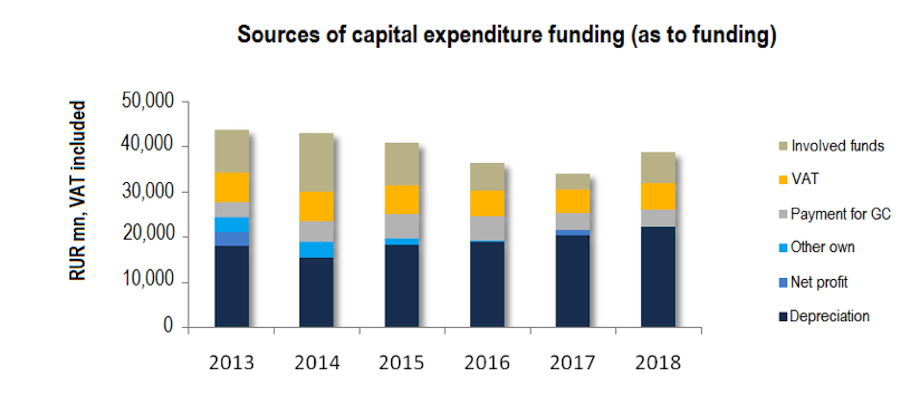

In connection with the tariffs “freezing”, the Company adjusted the plans regarding the sources of the investment program funding. The amount of borrowed funds for investments was increased (relative to the approved program for 2014-2017) from RUR 23.8 bn to RUR 32.2 bn, that is by RUR 8.4 bn, or 35%, resulting in 21% share of borrowed funds to finance the investment program of the mentioned period. Meanwhile, the growth of the debt burden is not critical for the relation debt/EBITDA: the maximum value of the relation will be 2.29 in 2015.

Table 1. Main figures of 2013-2018

| Indicator | Unit of measurement | 2013 expected | 2014 | 2015 | 2016 | 2017 | 2018 |

| Financial indicators | |||||||

| Revenue (total) | RUR mn | 125,289 | 127,979 | 131,098 | 134,893 | 138,705 | 148,995 |

including electricity transmission revenue* | RUR mn | 111,808 | 115,677 | 118,724 | 122,846 | 128,435 | 138,569 |

including grid connection revenue | RUR mn | 12,792 | 11,126 | 11,083 | 10,627 | 8,708 | 8,708 |

| Prime cost (total) | RUR mn | 104,560 | 111,191 | 116,878 | 121,308 | 125,977 | 134,153 |

including purchased electricity for loss compensation | RUR mn | 12,789 | 13,865 | 14,147 | 15,295 | 16,708 | 18,277 |

including services of JSC “UES FGC” | RUR mn | 13,645 | 14,395 | 14,818 | 15,732 | 16,744 | 17,828 |

| EBITDA | RUR mn | 36,335 | 35,551 | 39,155 | 40,177 | 40,589 | 45,209 |

| Net profit | RUR mn | 11,008 | 7,848 | 8,236 | 8,459 | 7,927 | 9,591 |

| Net debt | RUR mn | 58,976 | 70,679 | 76,031 | 78,500 | 75,783 | 75,071 |

| Net asset value | RUR mn | 177,856 | 182,951 | 189,225 | 195,625 | 201,437 | 209,046 |

| Average price of electricity purchase for loss compensation | RUR/kWh | 1.68 | 1.88 | 2.03 | 2.21 | 2.38 | 2.56 |

| Average electricity transmission tariff | RUR/MWh | 1,599.6 | 1,634.4 | 1,652.6 | 1,681.3 | 1,727.9 | 1,830.7 |

| Production indicators | |||||||

| Electricity productive supply | mn kWh | 80,110 | 81,567 | 83,311 | 84,910 | 86,549 | 88,296 |

| Electricity losses in g rids | mn kWh | 8,106 | 7,847 | 7,426 | 7,407 | 7,496 | 7,630 |

| Amount of connected capacity | MW | 1,151 | 1,078 | 925 | 925 | 900 | 900 |

| Other indicators | |||||||

| Repair program, | RUR mn | 5,208 | 4,940 | 5,145 | 5,265 | 5,396 | 5,623 |

* net of losses under load

Investment program for 2014-2018

The investment program for 2014-2018 was finalized under the instructions of Russia’s Energy Industry Ministry dd. 23.09.2013 subject to the tariffs zero growth rate as from 01.07.2014 and establishment of tariffs for the next years on the level of the inflation of the previous year.

The draft investment program for 2014-2018 was submitted by JSC “Russian Grids” to Russia’s Energy Industry Ministry on 21.11.2013 with a view to its subsequent submission to the federal and regional authorities and to JSC “UES SO” for coordination, after which the draft investment program has to be approved by Russia’s Energy Industry Ministry in the manner prescribed by Government Resolution #977 dated 01.12.2009.

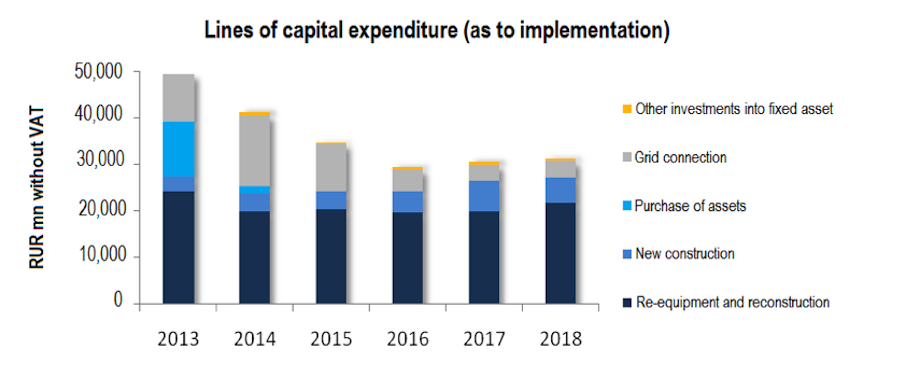

The volume of funding of the capital expenditure for the long-term investment program regarding the years 2014-2017 decreased in comparison with the approved investment program for the same period by RUR 30.1 bn, VAT included, in particular in 2014 – by RUR 13.9 bn, VAT included. This decrease was due to the revision of priorities between the lines of spending the funds in favor of the distribution grid which is the most worn out and open to technical incidents (which was partially implemented during the adjustment of the 2012-2013 program), optimization of technical solutions for high-voltage electric grid facilities, reduction in the cost of construction/reconstruction of electric grid facilities in accordance with approved Strategy of Electric Grid Complex Development in the Russian Federation. A number of investment projects were excluded from the investment program as a result of observations from approving enforcement authorities, which caused reduction in transformer capacity input against the approved investment program (of the years 2014-2017) by 2,766 MVA. At the same time, the adjusted investment program involves an increase in power lines commissioning in relation to the approved amount from 6,611 km to 15,199 km, i.e. by 8,588 km, or 2.3 times.

Major changes to the previously approved program are associated with entering into new contracts for grid connection and inclusion of new facilities for development of New Moscow territories, which led to an increase in the share of new construction from 26% to 39% and reduction in the share of re-equipment and reconstruction from 74% to 60%.

Compared with the previously existing program (the years 2014-2017), the total amount of funding is reduced by RUR 30.1 bn at the expense of the activities listed above; meanwhile, the own funds were decreased by RUR 38.5 bn, borrowed funds were increased by RUR 8.4 bn.

The expected results from the implementation of the investment program of JSC “MOESK”:

- reduction in the number of the closed feeding centers by 31.12.2018 from 157 pcs. to 55 pcs.;- enhancement of electricity productive supply by 2018 to 95,926 mn kWh;- energy effect of the implementation of energy saving and energy efficiency improvement programs for the years 2014-2018 - 836 mn kWh.

The presented parameters of the investment program for 2014-2018 are forecast and can be adjusted after their approval by Russia’s Energy Industry Ministry in accordance with the existing normative regulations.

*****

JSC “Moscow United Electric Grid Company” (JSC “MOESK”)

- one of Russia’s largest distribution electric grid companies.

JSC “MOESK” ensures electricity supply to the Moscow Region, which is the most dynamically developing region in the country with a population of about 17 million people. Main activities of the company – electricity transmission services and services of grid connection to electric grids in Moscow and the Moscow Area.

The controlling stake of JSC “MOESK” (51%) is owned by JSC “Russian Grids”.

JSC “Russian Grids” - Russia’s largest energy company ensuring transmission and distribution of electricity.

The length of power lines of the Company is 2.3 mn km, transformer capacity of 463 thousand substations is 726 GVA. Number of the personnel of the Group of Companies “Russian Grids” - 213 ths. highly skilled professionals.

The Company’s property complex includes stock holdings of 43 subsidiaries and dependent entities, including shareholdings in 11 interregional and 5 regional grid companies. The controlling shareholder is the state, which owns the 61.7% stake in the charter capital.

Pursuant to implementation of the Decree of the President of the Russian Federation, in June 2013, the RF-owned share holding of JSC “UES FGC” was transferred to the company as a contribution to its charter capital.

IR division of JSC “MOESK”

Tel.:+7(495) 984-57-74; +7(495) 984-57-72